Integrated Investment Sustainability Internet Project.

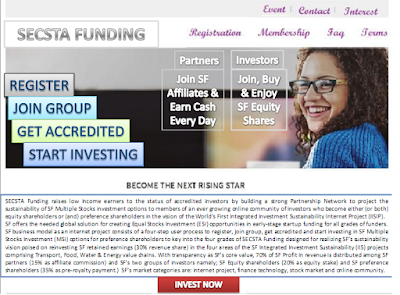

SECSTA Funding is getting ready for building bridges to the destiny of investors by linking global investors from different destinations invited to fund its Integrated Investment Sustainability Internet Project.

The first thing to record about what SECSTA Funding and Stripe Atlas Share In Common is Stripe’s point in the section of global access to startup tools, which states that “With Stripe Atlas, entrepreneurs can easily incorporate a U.S. company, set up a U.S. bank account, and start accepting payments with Stripe. Starting today, it’s available to developers and entrepreneurs globally.”

This is not to say that SECSTA Funding will do what Stripe has as its purpose but concerns how SECSTA Funding exists for individual investors around the globe to play a role in funding the global socio-economic waste management investment portfolio of SECSTA Funding and thereby benefiting from the returns generated from its operations as the World’s First Integrated Investment Sustainability Internet Project.

The First point to note is that what entrepreneurs do with Stripe is what investors will always do with SECSTA Funding, and that is, since stripe makes payment for online businesses easier around the globe, SECSTA Funding makes investment in internet projects easier for investors around the globe.

Part of Stripe’s mission states that “The promise of the internet is that location matters less. However, geographic barriers and associated complexity make it difficult to start a global business in many parts of the world.”

The same stance holds true for investment portfolios that are associated with the internet, while SECSTA Funding turns around the limitation of funding multiple investment portfolios by creating an integrated investment sustainability internet project, there will no longer be geographical barriers since every funding can be done from anywhere irrespective of location because SECSTA Funding is an internet project.

A part of the belief of Strife evident in its mission statement is that “Developers around the world should have equal access to the tools and services that are available to those in Berlin and Boston. Atlas is designed to help.”

The similarity in the belief is that SECSTA Funding has designed its Multi Stock Investment (MSI) options units Investment options because it believes that low income earners around the world should have equal access to investment portfolios that will help them become accredited investors rather than merely reserving its investment portfolios for angels and VCs to fund.

In the summary of Atlas Guide: Starting a real business, Stripe stated with assurance that “You should concentrate on making something people want and getting it to them; Stripe can help you with the details. We have put together a primer explaining accounting, taxes, employment, and more. Learn what you need to quickly, so that you can get back to the more important work of building your business.”

The point on getting help with the details resonates with SECSTA Funding which

creates the friendly environment for global investors to buy its shares without

worrying about how the funds will be utilized. While on its own part, SECSTA

Funding considers the important sectors for investing the funds contributed by

its investors in order that they will yield the greatest profit in the shortest

possible time.

This

is what it captures in its four cardinal areas of focus of a Sustainability

Vision. With this in mind, SECSTA Funding asks investors not to worry about how

their bought shares will be invested.

A Big Picture of the Investment Portfolios Managed By SECSTA Funding

Investors

are able to choose their areas of investment and fund it. But first they must

wait before they can start getting dividends. Earnings are distributed when

investments generate revenue, and there are other royalties paid to every

investor in different percentages of their bought shares in all three areas of

the SECSTA Funding investment portfolios namely: Preference Shares, Equity

Shares and Income Shares.

For

the first time ever there is a diversified investment portfolio integrated in a

sustainability internet project such that the right investment condition is

created to attract investors from different walks of life. SECSTA Funding’s

investors have three options to choose as their preferred investment portfolio

where their funds will be contributed as stakeholders in the SECSTA Funding’s

Sustainability Vision.

Hence,

those invited to SECSTA Funding are ordinary people to buy ordinary shares

known as Preference Shares, and anybody can invest in SECSTA

Funding’s preference shares if the person can afford the lowest entry amount

for accreditation which is $21.

The

second group of people invited to SECSTA Funding is accredited investors to buy

prominent shares known as Equity Shares, and any investor or

company can trade equity with SECSTA Funding if the minimum fund of $1000 can

be provided to fund the lowest unit of SECSTA Funding’s Equities.

Then,

last but not the least, the third group of people also invited to use SECSTA

Funding are regular income earners to buy private shares known as Income

shares, and any paid worker who can afford any pension plan with SECSTA

Funding is allowed to choose the least plan costing 5% of their monthly income,

no matter the amount of income earned regularly, can invest in SECSTA Funding

as an income shareholder.

Where SECSTA Funding Differs From Stripe on Business Strategy

The only thing which SECSTA Funding doesn’t share in common with Stripe is the invitation-requirement for using the platform, as SECSTA Funding doesn’t require any form of application review for accepting people using the platform, anyone can access SECTA Funding’s shares at anytime and every investor is free to fund whichever membership level is desired to get started.

But Stripe differs here as shown in the Stripe Atlas Network where it is worth noting that, “Stripe Atlas is invite-only to start’ says Stripe, ‘We’ll be scaling it to as many companies as possible as quickly as we can. You can apply directly or get a referral from one of our partners."

This approach is not out-of-place, however, because Stripe receives a number of applications from global brands which it charges a fee for and it is in that way that it generates its revenue which has grown to $9 billion in January 2017.

Without this approach, Stripe will be a non-profit local support company helping global brands get into U.S virtually, for their incorporation, business account opening, payment acceptance, and tax and legal guidance.

This is what Stripe is about, and it uses online applications to achieve its purpose to bring thousands of global startups to U.S. Such is a clever business strategy for promoting foreign investments in the U.S.

This strategy is favorable to Stripe as well as serves for the benefit of the U.S government which becomes the hub for all businesses needing to accept U.S payment as the attractive force for getting incorporated in U.S and opening a U.S business account.

Stripe’s business strategy builds a financially viable U.S economy and that is indeed one reason the U.S. government will give Stripe its maximum support, and what about SECSTA Funding, does it favor the governments like Stripe does for the U.S. Government?

The Objective Impacts of SECSTA Funding that Exceed the Economic Impact of Stripe

Indeed, SECSTA Funding’s sustainability vision for socio-economic waste management does not merely favor one government but favors the world government.

It is imperative to note, particularly, how SECSTA Funding is also using the internet to gather investors from all over the world. Investors may either access the internet project directly or be referred by any of SECSTA Funding partners who earn 15% commission any investor they refer who funds any investment portfolio.

SECSTA Funding manages the funded investment portfolios by tracking investors’ data stored in safe retrieval systems needed for contacting investors and distributing their returns on investment, but first, the funds contributed by the investors must be used by SECSTA Funding to finance its diverse socio-economic sustainability projects in different developing economies around the world.

SECSTA Funding achieves its global development options through Public-Private-Partnerships by standing as the bridge builder to developing the poor economies of the world. It focuses on its four cardinal areas of interest in investment sustainability namely integrated transport, integrated green food, integrated clean water and integrated renewable energy with global socio-economic impacts.

By so doing, SF seeks to achieve the unification of socio-economic development in all parts of the world while funds keep coming from investors around the world and the returns are distributed among all the investors achieving the set timeline for investments to generate revenue profitably.

The Hallmark of Achieving SECSTA Funding’s Global Development Milestones

Over and above all landmarks, the development impacts of global integrated investment sustainability projects financed by SECSTA Funding are enjoyed in all parts of the world where SECSTA Funding enters a development partnership with the governments.

SECSTA Funding is positioned as a stakeholder and pioneer of global sustainable socio-economic development and human capital waste-management initiative. Its global development milestones are earmarked as hallmarks of its competence in developing global economic growth capacities.

The Commonality of Both SECSTA Funding and Stripe Working With Partners

There are also some common aspects of who SECSTA Funding is working with and who Stripe is working with.

According to Stripe “We’re working with more than a hundred accelerators, investors, and partners from around the world to get Atlas in the hands of promising startups. In addition, we’re working with some selected companies to make it easier for Atlas startups to take advantage of services: for example, AWS will extend $15,000 in free credits.”

On the side of SECSTA Funding, over 100,000 partners are invited to help SECSTA Funding find investors around the world. The ideal investors are those who will become lifelong stakeholders funding SECSTA Funding’s Sustainability Vision.

Thus, everyone who may wish to partner with SECSTA Funding is invited to send an email body “Please Add Me” to secstafunding@gmail.com. These prospective partners will be automatically added to the partner’s page once the SECSTA Funding launches its partners’ pages where partners will get their links activated in order to refer investors to SECSTA Funding for onward investment.

How SECSTA Funding and Stripe Share A Unique Value for A Strong Trust Edge

Another important value which SECSTA Funding shares with Stripe for building a strong trust edge is transparency.

Stripe is clearly transparent in its pricing by publicly stating the costs of using its services so that anyone applying may already know the cost ahead of the application to readily make any payment in advance of the application acceptance. This is seen in the section about “What does it cost?”

According to Stripe, “Atlas costs $500 during the preview, which includes all fees associated with incorporating your company and opening your business bank account. You’ll pay Stripe’s standard fees of 2.9% + 30¢ per successful charge. Read more”

SECSTA Funding’s transparency is visible in its open communication system for investment costs sorted in valuation tables showing how much can be invested and which percentage of return to expect for each level of investment.

More so, every investor is graded transparently, so it becomes convenient to invest at any grade where you can easily afford the cost of the investment.

As a matter of transparent costing, the investment valuation tables are visible for the three types of investors accessing any of the three SECSTA Funding investment pages. The investors, thus, know how much they will invest in each investment portfolio they choose.

With foreknowledge of value invested and valued to be added by SECSTA Funding after investment, the investors can get ready for the payment while progressing with their registrations.

Moreover, there are no hidden costs, so a one-time investment funding gets the investor ready to start enjoying SECSTA Funding’s distribution of dividends when the investments start generating revenue.

How SECSTA Funding and Stripe Give Access to Information A Central Place

Another common thing between SECSTA Funding and Stripe is the public access to information on how it works. Stripe shows its public access to information in the section on ‘What exactly do I get?’

According to its own statement, “Stripe Atlas will help to incorporate your company in the U.S., open a business bank account, and create a Stripe account so you can charge customers around the world. You’ll also get access to support from PwC, Orrick, and AWS. Read more.”

That’s a fine way of giving you quick information to enhance your knowledge of the value to expect for your money, so you may make an informed payment to Stripe when applying.

In same vein, SECSTA Funding has dedicated a page to giving information about what to expect from it as can be found in the FAQ section which answers all the questions an investor may ask.

The SECSTA Funding’s FAQ page for investors tells you everything you need to know about the different investment portfolios for investors to fund and about its management of the funds contributed in the integrated investment sustainability internet project.

SECSTA Funding’s FAQ responses show how revenue will be generated for investors from the funds to be invested in the Integrated Transport project, explaining its four sectors, as well as revenue from its Integrated Green Food for global food sufficiency, and from two others namely, Integrated Clean Water value chain and Integrated Clean Energy value chain all explained in detail.

One Last Tip to Take Home

Kindly note that SECSTA Funding is getting ready for building bridges to the destiny of investors by linking global investors from different destinations invited to fund its Integrated Investment Sustainability Internet Project.

And so, as an intending investor you must remember that you can never be too early on SECSTA Funding, so get ready to start your fund your first investment portfolio on SECTA Funding once the platform goes live. But you must stay updated on what is new on SECSTA Funding.

Ultimately, to stay up-to-date on the timing for the launching of SECSTA Funding, for you not to miss any second of your chance to be among the first investors, subscribe to the temporary mailing list of SECSTA Funding by sending an email body “I need launching update” to secstafunding@gmail.com.