Are Pension Investments The Best Long Term Savings Schemes Preferable To Medium/Long Term Equity Trades, As An Alternative To Pension Schemes, For Securing Your Financial Future?

If you believe pension schemes

are good because they are long term savings schemes that are projected to be

the best way to secure your financial future, you are not far from the truth,

but talking about the best way to secure your financial future, have you tried

medium term equity trades?

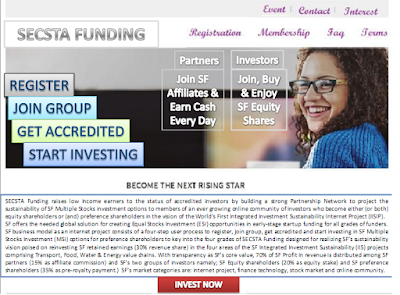

At SECSTA Funding, we believe we

have got the best alternative to pension schemes for securing your financial

future and that alternative is our very own equity shares investment

opportunity for all public and private employees, who are prospective pensioners,

supposed to prefer having a CPPIA; under an accountable and profitable SFAPEI,

to having a PPA; under a fraudulent and unaccountable government.

Who Should Trade Equity with SECSTA Funding?

Anyone who has a pension account

is the right person to trade equity with SECSTA Funding because this is the

best way you can be sure of what your long term savings are used for, rather

than the government pension schemes like PenCom that keep increasing their

assets annually as 2014, 2015, and 2016 reports of rising pensions assets

shows, whereas the money claimed to be free of fraud are used for funding

government bonds without accountability to the pensions.

In an article written by Nike

Popoola titled “Pension assets rise to N6.02tn” highlighted as a Punch report in

Business & Economy under Financial & Economic News on LinkedIn, published

on January 19, 2017, it was noted that, “Despite the impact of recession on the

Nigerian economy, the total funds under the Contributory Pension Scheme rose to

N6.02tn at the end of November 2016.”

The reporter noted further that “According

to the commission, the funds rose from N4.6tn at the end of the 2014 financial

period to N5.3tn in 2015.” This was a sign of a growing contribution of the

public to secure their financial future.

According to the report, “The

Director-General, PenCom, Mrs. Chinelo Anohu-Amazu, said the funds were being

well managed, adding that no fraud had been recorded under the scheme.”

However, we should note at once

that, even though the fund’s management may not be in dispute, we think there

are still other aspects to consider when analyzing a report such as this, and

that is the concern that, are the funds used for the purpose they are meant? Who

benefits at the end of the day?

Some Critical Points to Note about Public Pension Accounts PPA

It is a critical issue to note

here that pensioners are not paid their due upon retirement and a lot of

reports from these hungry, aged and desperate people have been disregarded by

the managers of the pension funds.

The question is, if the pension funds

are meant for the pensioners, why are they still not paid to them when due,

since non-pensioners are still contributing to the fund? Why is it difficult to

pay the pensioners their due? What about interest accrued on such a long term

savings, who gets rewarded at last?

We interviewed a pensioner named Mr.

Edward Anaele who narrated his ordeals with the state government of Imo State

in South-Eastern Nigeria, just recently, by December 2016.

We noted from his narrative his

bitter experience of how the governor of Imo state offered the pensioners in

the state a duel to either forfeit all their pension funds or agree to sign an

undertaken stating that they will each accept only 50% of their pension fund,

while the government will keep the remaining 50%.

According to De Eddy, as the

narrator is known by his family at home, the undertaken was signed by him like the

other pensioners who sought refuge in their half-bread which they believed was

better than none.

The pensioners in Imo State

unanimously signed a fraudulent undertaken to accept only 50% of their pension

funds and so forfeit the remaining 50% to the government, yet even the agreed 50%

meant for them was not paid, and the government went on air to announce that

all pensioners have been paid.

Isn’t this a case of unmasked fraud?

Not only is the government directly involved in negotiating fraudulent

percentages of lower pension funds to be paid to aggrieved pensioners, but the government

gambles with the pensioners’ sweat.

This is a case of sheer

inhumanity, especially when the pension funds are not paid to those whose due it

is at the right time. How is it that upon promise to pay a defrauded amount to

pensioners, the government still feels just to deny pensioners their due having

made them forfeit half their pension funds?

Isn’t it criminal that the same

fund has always been in the possession of the government with accruing interest

to the management board behind the scheme, yet those who contributed the fund

are denied it when due?

According to the report under

review, Anohu-Amazu was quoted stating some management claims of innovations in

having “instituted a stiffer regime of sanctions and penalties for

infringements, ensured the upward review of the minimum rate of pension

contribution in order to enhance the value of pension pay-outs, and expanded

the coverage of private sector employees under the CPS.”

How to Deal With the Problem For Defrauded Pension Funds Once and For All

To juxtapose the above claims

with the story narrated by the Pensioner mentioned above you notice an outright

contradiction in what is claimed and what is the actual case, there is no

enhanced value of pension pay-outs as claimed, instead there is loss of above

50% of the pension due the pensioners in many cases. What could be responsible

for this?

The reason could be seen in the

further points noted in the report which added that “The Chairman, Pension Fund

Operators Association of Nigeria, Mr. Eguarehide Longe, said the pension funds

were active in different investment portfolios. According to him, the bulk of

the funds is invested in government bonds, which the government has invested

some in infrastructure.”

The above is the typical case of

a defensive attempt to cover gross government frauds. If the pensioners are not

able to get their funds contributed in the scheme at the end of their services

in private and public sectors, then it is a waste of precious years making such

a long term savings which do not really guarantee the security of your

financial future. So it is best to think of a better alternative to PPA.

How Is SECSTA Funding Offering A Relief To Forestall The Defrauding of Pensioners By the Government?

Seeing that government is not

accountable for returns from PPA pension funds active in different investment

portfolio which are mainly government investments, as reported above, is there

any need deceiving employees that their pension funds will ever secure their

financial future? The answer is no, if the opposite is the case, since pensioners

are defrauded by the government at the end of the day?

There is no need hiding the truth

in a bid to protect the image of the government. So, without asking employees

not to contribute to the government pension schemes through Public Pension Accounts

(PPA), SECSTA Funding has created a more reliable investment portfolio known as

SECSTA Funding Alternative Pension Equity Investment (SFAPEI) scheme, and this

is for employees who deserve to have a Complementary Personal Pension

Investment Account (CPPIA) with SECSTA Funding.

What is the SFAPEI CPPIA About and How Is It Better that Government PPA?

The SFAPEI Complementary Personal

Pension Investment Account (CPPIA) is for every employee to stay in control of

securing their financial future by themselves using their own contributions to

invest in the best investment portfolio known as SF Integrated Investment Sustainability

Internet Project (IISIP).

SF IISIP is where SFAPEI is able

to ensure employees having the CPPIA can see their funds yielding dividends in

the long term and they themselves will be the ones to benefit from their

investments rather than letting the fraudulent government to defraud them and make

them forfeit even their life savings.

The Frequently Asked Questions

section of the SF site gives the entire details on what the SFAPEI funds are

invested in, and how to invest in it, as well as what to expect from it at the

end of year, in terms of sustainability reporting that shows how the pension funds

have been invested and how much dividends are to be anticipated by the

alternative pensioners at the end of their service year.

Why You Should Now Take Action With The SFAPEI For The Ultimate Solution To Pension Frauds?

The unique thing which makes the

SFAPEI scheme the best long-term savings preferable to other pension schemes

managed by the government is that the pension funds invested in SF IISIP are not

hidden until the end of a pensioner’s active years of service.

On the contrary, the prospective

pensioner knows what is happening in the investment portfolio where his pension

funds are active, and knows what to expect as enhanced pension pay-outs; which

will be far over 600% of the total fund contributed by the individual pensioner

through a monthly income deduction from the employee’s salaries to fund the

CPPIA on a monthly basis.

SFAPEI extols accountability over

profitability and yet guarantees both accountability and profitability so that

pension funds yield profits to the pensioner and there is no loss to the

pensioner.

Now answer the big question: which

will you prefer as an employee, today, if offered the option to choose between putting

your life savings in either “the unaccountable and fraudulent Public Pension Schemes”, with Anticipated

Losses, or choosing “the accountable and profitable Personal Pension Scheme with SFAPEI?

Guaranteeing the Security of Your Financial Future with SFAPEI

You will find that it is more

satisfying to know you have an SFAPEI Complementary Personal Pension Investment

Account (CPPIA) than to have a Public Pension Account (PPA) with the government;

because, even as the latter keeps counting trillions of Naira in increased

total pension asset value, no pensioner gets 100% of the fund contributed at

the due time for pension arias, and no one gives account of the reason for

losses to pensioner.

Therefore, working with SFAPEI is

the wisest way to secure your financial future. You should now think of being

among the first beneficiaries of the innovative alternative pension equity

investment scheme by having your own Complementary Personal Pension Investment

Account (CPPIA) opened with SECSTA Funding today.

Finally, if you are interested in

the SFAPEI scheme and you prefer to have a CPPIA with SECSTA Funding, where you

will make profit on your pension funds, and get annual account of the status of

your pension funds, you may now get started by sending an email body saying, “I

am interested in SFAPEI, and I want to have my CPPIA created in 2017 with SECSTA

Funding.” to secstafunding@gmail.com.

No comments:

Post a Comment